The profitability of oil palm crops in the tropical climates of Latin America and the Caribbean is drawing increasing interest. In 2019, the region accounts for 6.2% of global palm oil production (Expert Market Research, 2019). At the same time, some countries within the region rely on palm oil import to fulfil their growing demand.

Where are Latin America and the Caribbean?

Latin America is generally referred as the entire continent of South America in addition to Mexico, Central America, and the islands of the Caribbean whose inhabitants speak Spanish, Portuguese or French language. The people of this large area shared the history of colonisation by the Spaniards and Portuguese from 15th to 18th century. According to Brittanica, the countries within the region are as follows (refer to Map 1):-

Map 1: Latin America and the Caribbean

Palm Oil Production and Trade within the Region

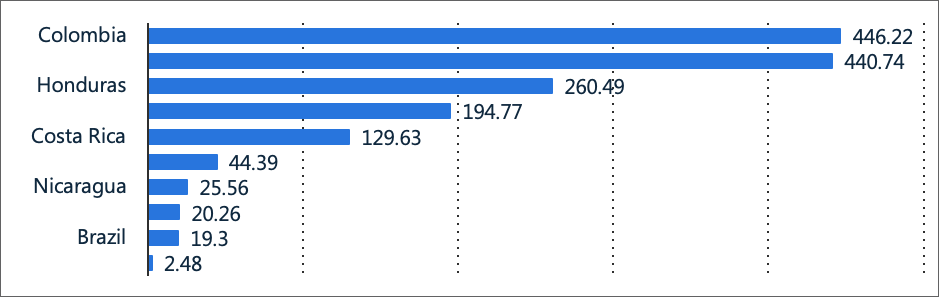

Total palm oil export by Latin America and the Caribbean attained a value of USD 1.59 billion in 2019 (Statista). Two years earlier, that value was equivalent to USD 1.33 billion. Colombia has the highest value of palm oil exports with exports equivalent to USD 446 million, followed by Guatemala with a value of USD 440.74 million (Refer to Graph 1).

Graph 1: Latin America and the Caribbean: Palm Oil Export Value 2019 (in million USD)

Colombia is the largest palm oil producing country within Latin America and the Caribbean, producing around 1.6 million MT annually and contributing 2% to global supplies (Food Navigator, 2018). The area planted with palm oil trees in Colombia is around 541,000 hectares. The Netherlands is the main buyer of Colombian palm oil followed by Brazil, Spain, Mexico and Germany.

After Colombia, Guatemala has the second largest palm oil production in the region, at around 852,000 MT, with oil palm planted area extended to nearly 190,000 hectares. The Netherlands is the main buyer of Guatemalan palm oil, with export reaching a value of over USD 171 million in 2019(Statista). Other export destinations of Guatemalan palm oil are Mexico, Germany and El Salvador.

In Ecuador, palm oil production has been growing since 2013. Production is expected to reach 630,000 MT by 2019, up from 580,000 MT produced the year before. Ecuador has the second largest oil palm cultivated area at around 246,000 hectares in 2019, down from 370,000 hectares four years earlier (Statista). Ecuador’s main country of destination for palm oil export is Colombia, with an export value of around USD 146 million. Other export destinations include Mexico, the Netherlands and the US.

Brazil has an 180,000 hectares of oil palm planted area producing about 500,000 MT of palm oil, where Agropalma is one of the country’s largest palm oil business. Agropalma operates oil palm estates, mills and a refinery in Pará in Northern Brazil, where about 15% of its production is exported to the EU and US (Agropalma, 2017). Due to high local consumption, Brazil has to import palm oil mostly from Colombia, with imports reaching a value of more than USD 74 million out of USD 141 million of the total palm oil import value in 2019 (Statista).

Palm oil industry in Mexico is considerably smaller at 109,000 hectares of planted area and its palm oil production stood at about 140,000 MT (Statista). Mexico has to rely on import where it is the biggest palm oil importer within Latin America and the Caribbean. Palm oil is imported largely from Costa Rica, with imports hitting over USD 108 million out of USD 285 million in 2019.

Palm Oil Consumption and Application

The country with the largest palm oil consumption from the region is Colombia followed by Brazil and Mexico. In 2019, palm oil consumption in Colombia was estimated to attain 1.13 million MT, while palm oil consumption in Brazil is estimated to reach 750,000 MT, up from 710,000 MT consumed in the previous year, followed by Mexico consumption at 640,000 MT (Statista) (Refer to Graph 2).

Graph 2 : Latin America and the Caribbean: Palm Oil Consumption 2019 (‘000 MT)

Being the largest producer within Latin America and the Caribbean, about 30% of Colombian palm oil production is exported while the balance is domestically used. Colombia and other countries of Latin America and the Caribbean have a cooking culture based on frying. The region is home to a wide variety of culinary delights, each using a distinctive combination of spices and fresh ingredients. Local Colombian crude palm oil is also sold to the edible oils and fats industry and to other industry sectors, such as soaps and biodiesel industries. Palm oil is an integral component of the biodiesel industry in Colombia, which is mandated by law to account for 10% of the total automotive fuel sold in the country (Expert Market Research,2019).

On the other hand, 20% of Brazil palm oil intake comes from import where the consumption in Brazil has been increasing during the period between 2008 to 2018. This is attributable to the rising demand from food and beverage, personal care and cosmetics and detergent. CPO dominated the Brazilian palm oil market with a share of 56.5% in 2019. Also, RBD palm oil is extensively used in domestic cooking. In Brazil, palm oil is considered as an economical alternative to other edible oils such as soybean oil and sunflower oil. With high acceptance among food processors, the segment growth of palm oil in the country is expected to boost (Grand View Research, 2019).

Sources :

- Expert Market Research. https://www.expertmarketresearch.com/reports/latin-america-palm-oil-market

- Brittanica. https://www.britannica.com/place/Latin-America

- Agropalma Sustainability Report, 2017. https://www.agropalma.com.br/arquivos/relatorios/BX3_EN_AGP_016_Relatrio-sustentabilidade_REVISADO-1548333911.pdf

- Both Ends Annual Report 2019. The spread of palm oil in Latin America. http://annualreport.bothends.org/palm-oil/

- Food Navigator, 17 April 2018. Consumer demand for palm oil in Latin America. https://www.foodnavigator-latam.com/Article/2018/04/17/A-beautiful-white-page-Consumer-demand-for-palm-oil-in-Latin-America

- Grand View Research, July 2019. https://www.grandviewresearch.com/industry-analysis/brazil-palm-oil-market

- Statista

- Index Mundi

Prepared by: Nur Adibah Mohd Razali

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.